Investing in stocks can be a daunting task for new investors. But the good news is that it can be as easy as opening a brokerage account and investing in the stock funds.

Depending on your skill level, you can invest in stocks in many different ways. One of the most important is understanding what you should do and how to do it. If you are not an expert, you might want to hire an investment advisor to help you make your investment decisions. However, if you are not in a rush, you can take a more hands-on approach.

A good rule of thumb is to invest about 70 percent of your money in stocks and about 30 percent in other types of investments. You can diversify your investment portfolio by placing a small percentage in fixed-income securities such as bonds and CDs. This can help reduce your risk and can also allow you to ride out market fluctuations.

The key to maximizing your profits is to buy the most reputable companies at reasonable prices. Companies with strong track records of growing sales are usually the best bets. In the long run, this is a surefire way to generate income from your investments.

Keeping your portfolio balanced will also help you manage risk. For example, you might decide to focus on high-growth companies or to take the opposite approach and hold shares of companies with weaker financial histories. Whatever you choose, it is a good idea to have an emergency fund. Having this type of reserve can help you withstand large drops in stock price or early withdrawals of investment funds.

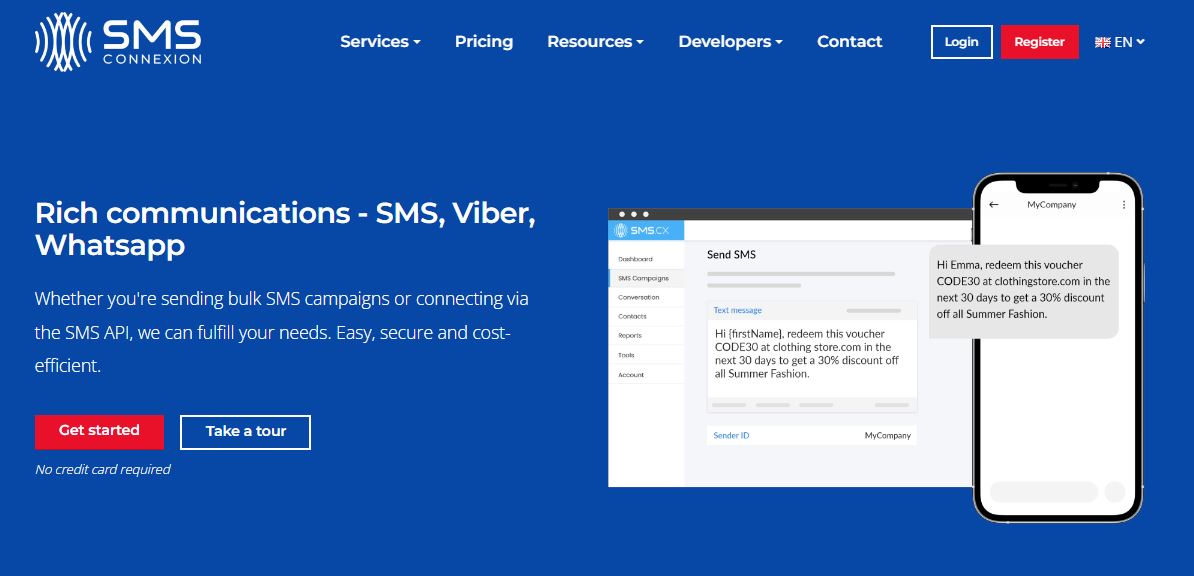

There are many tools and resources available to learn more about the investing world. You can do some research at an online broker, in your favorite newspaper, or by reading a book. Whether you choose a human advisor or a robo-advisor, a brokerage account can be an easy way to begin your investing journey.

While there is no one best way to invest in stocks, there are several steps you should follow to get the most out of your investments. Some of the best brokers will offer free research to help you determine what to buy. Another tip is to keep the process simple. Using a robo-advisor can eliminate most of the hassles, but you still have to choose your investments.

The most important thing to remember when investing in the stock market is to diversify your portfolio. Putting your money in the same stock, mutual fund or ETF isn’t a good idea because you might end up losing money if that company crashes or fails. Therefore, it is important to mix it up by putting money in other areas of the market, such as bonds, commodities and real estate.

While the stock market is a volatile place, it can be a great way to grow your savings. Investing in stocks can be a smart move, especially if you are young and have a few decades before you will need the money.

What Are Stocks and Shares?

Stocks and shares are terms that are often used interchangeably. However, it is important to understand the differences so that you can make an informed decision about whether to buy or sell. The more you know about stocks and shares, the more likely you are to become an investor who earns a profit.

While there are many types of stock, there are just two main kinds. These are common shares and preferred shares. Common shares are issued by companies and are generally traded on stock exchanges. They usually pay dividends, but do not have voting rights. On the other hand, preferred shares are not typically traded on the stock exchange, but entitle holders to receive dividends before other common stockholders.

Typically, a share is a piece of property that gives the owner a certain percentage of the profits a corporation makes. This percentage is based on the value of the company. It also gives the owner a small ownership stake in the corporation. Since stocks represent a large portion of a company’s assets, their value can fluctuate. As such, the price of a share depends on the market.

One of the biggest benefits of investing in shares is that they offer higher returns than cash-based investments. While the potential for capital growth is appealing to many investors, the risk of loss can also be significant. Therefore, it is a good idea to diversify a portfolio. If you are going to purchase shares, consider the companies with the most potential for long-term growth. Some examples of companies with sustained growth are technology, pharmaceutical, and environmental stocks.

Another factor to consider is the level of volatility in the markets. Investing in stocks is usually a good idea when the economy is growing, but it can be a bad idea when it is stagnating or down. When a company begins to falter, the share price falls. By the same token, when a company is thriving, the share price can rise. Similarly, when a company starts to run out of money, the shareholder may lose their investment. Although there are no guarantees, the value of a share can increase over time.

Stocks are an alternative way for investors to own some of the world’s largest corporations. Companies issue stock as a way to raise funds for their business, find investors, and grow their businesses. In the United States, the stock market is regulated by the New York Stock Exchange. Other stock exchanges operate in other countries, such as the Bombay Stock Exchange in India.

When buying or selling shares, there are several factors to keep in mind. For instance, you can invest in an ISA, or a tax-efficient way of holding shares. You can also rebalance your share holdings to reduce your exposure to one company. A blue-chip stock has a solid reputation and is one of the most reliable types of investments.

Finally, you should keep in mind that there are various kinds of shares, each corresponding to a different kind of company. There are also other terms that can be used to describe shares, including equities, equity, and securities.

What is the Stock Exchange?

A stock exchange is a marketplace where securities are traded. It is an official, organized market, based on the rule of law. In order to be listed, a company must meet certain requirements. This allows it to raise capital, and eventually generate profits.

Companies can also sell shares in the stock market. They can do this through an initial public offering (IPO) or through a secondary market. The exchange facilitates the sale and purchase of various types of assets and financial instruments, including stocks, bonds, options, and futures. Shares can be bought or sold by the general public and companies, and are generally traded over the counter.

The stock exchange provides a secure place for systematic trading, ensuring that both parties arrive at a mutually acceptable price. Transactions are conducted between authorized agents of members, and are governed by rules and regulations formulated by the exchange.

Investors who choose to invest in the stock market seek liquidity. By investing in different companies, investors can reduce the risk of losing money if one particular company experiences a loss. However, it is still possible to experience losing streaks, and you should not make the mistake of gambling all your savings on a single company.

Generally, the prices of all stocks are determined by supply and demand. Prices are calculated based on the algorithms of computer programs. These are used to automatically calculate the price of a security.

The stock exchange is an electronic system that helps companies raise capital and provide a platform for selling and buying shares. It offers real-time information on the market. This information is crucial to efficient markets, and the speed at which it is distributed ensures that everyone has access to it.

Investors can buy or sell a share of a company through a broker, who acts as an agent of the company and the buyer. A broker is often an investment firm or a bank. Alternatively, a broker can be a single stockbroker who has a license to operate the stock exchange.

Buying and selling stocks is often done through a trading computer. The transaction process is order-driven and the orders are set up automatically with the help of a trading computer. Once the order is placed, it is matched with other orders and is displayed publicly. Consequently, the bid and ask are set at a difference, called the bid-ask spread. Traders can then select the shares they want to buy or sell based on the matching process.

Investing in the stock market is considered a safe and lucrative way to earn a profit. Often, the returns on this type of investment are greater than those on gold, which gives it an advantage over other investment methods.

The stock exchange has the ability to enforce regulations on brokers. It is also a way for companies to certify their soundness, so that investors can be confident that their money will be protected. Furthermore, being a member of a stock exchange can increase a person’s prestige.

What Is An Options Trading Alert Service?

Options trading alert services provide investors with a variety of educational resources. These include videos and other educational materials. They also offer advice on which strategies work best. The best options trading alert service is a great way to make better trades and increase your profits.

There are many different options trading alert services, and they differ in their design and methods. Some use advanced algorithms to analyze a large number of data and recommend the best trades. Others rely on speculation and trading practices by other traders. No matter which method you choose, you should keep in mind that the market is constantly changing.

Options are a risky investment, and you should always be prepared for the worst. This means that you should do your homework before investing. Learn about the asset you are going to invest in, and find an options trading mentor to guide you. Use the latest news sources and watch a variety of video tutorials to get the most from your experience.

Using a trading alert service can be a great way to save time and effort. It can also help you understand complex derivatives and give you a broader perspective. The best option trading alert service will have a strong track record of returns and will offer you useful tips and tricks that will allow you to improve your own trading abilities.

One of the most popular options trading alert services is Mindful Trader. The company is founded by Erick Ferguson, a professional trader who has been trading stocks for years. He presents 20-minute films that illustrate his analytical method. His stock picks are based on scientific data and his own trading strategies. You can also sign up for a video newsletter that contains real-time technical analysis and an evaluation of potential transactions for the next day.

The most important thing to remember is that making money with options takes time and expertise. While the market can be volatile, it’s possible to learn how to invest in options and gain substantial profits. If you are a beginner, it’s best to stick to one asset. However, if you are more seasoned, you might want to diversify your investments.

An options trading alert service is a great way of staying informed about the state of the market and new trading strategies. Some companies will send you an email or text message with their recommendations. Others will notify you when a team of professionals makes a trade.

Whether or not you use an alert service, you should always keep your trading platform open. Make sure you can place your trades quickly if an alert pops up. Even the best alert service may not be able to predict market movements. Keeping your platform and alerts open will ensure that you are able to make the most of your time.

Another useful feature of some options trading alert services is their social components. While these services will never give you a complete picture of the market, they can help you get hands-on experience. Many services will allow you to follow other investors’ trades and discuss their strategies with them.